Table of Contents

Firms operate in extended business networks. In order to be sustainably profitable, a firm needs to be able to operate in an attractive network position and to manage that position effectively by having powerful relationships with its customers and suppliers.

Critically discuss this statement, using relevant examples to illustrate your answer.

Table of Contents …………………………………………………………..…. 3

- Introduction ………………………….………………………………….. 4

- Part I: Firm positioning within the Business Network ……5

2.1. The attractiveness of the network……………………………………5

2.2. Re-positioning Strategy …………………………………………5

2.3. Outsourcing Strategy………………….…………………………6

- Part II: Marketing and Sales Management in Downstream Relationships …………….………………………………………….. 6

3.1. Maximizing Surplus Value ………………………………..…… 6

3.2. Setting Segmentation Strategy………………………………… 7

3.3. Obtaining and Retaining Customers ………………………… 7

- Part III: Procurement and Supply Management in Upstream Relationships ……………………………………………8

4.1. Value For Money concept ……………………………………….8

4.2. Supplier Selection ………………………………………………..8

4.3. Supplier Relationship Management …………………………..8

- Conclusion ………………………………………………………………9

References ……………………………………………………………………..10

Appendix ……………………………………………………………………… 12

- Introduction

In recent years, studies have showed that organisations changed the way they operate, particularly when analysing relationships between firms. Companies moved from a “value chain” system to a “business network” concept. The term extended businessin relation to a firm’s business network refers to the collaborative relationships among organisations incorporated within the supply chain process.

Nowadays, for many companies, having a sustainable advantage comes to customers and suppliers who control the principles of the extended business network by working toward a common approach through different value-adding activities to the ultimate customer.

In an extended business network, the firm is about creating a long-term competitive position thanks to a strong supply chain integration and collaborations. The essence of supply chain is as a strategic weapon to develop a sustainable competitive advantage by reducing investment without sacrificing customer satisfaction (Lee, H. L.; Billington, C. and Carter, B., 1993). A firm needs to operate in an attractive network and manage that position through powerful relationships with customers and suppliers. This brings us to a second point; what is an attractive network? and what influences a firm’s position has in a business network?The firms can play on different aspects (buyer, supplier, competitor) which generate different advantages and positions. These contribute to create an attractive network for the firms. In addition, power and network relationships are required to better understand the firms’ position and how to manage that position effectively.

The Powerof a firm influences its advantages and positions. It is the capacity of one firm to influence another regarding its resources. If one firm is dependent on resources of another firm, the second one has a power advantage over the first firm (Pfeffer and Salancik 1978; Sanchez and Heene, 1997 in Kimura, S., 2006). In general, a firm with a greater power advantage has a more dominant position in relation to other firms.

Network relationshipsconstitute the core aspect which connect actors, resources and activities in a business network. It creates competitive advantage to a firm’s position relative to its competitors. Michael Porter pointed out a firm’s competitive environment, relatively to its external environment the firm is in relation with.

At this point we can now focus on the issue, how to understand a firm’s position through its power and network relationships? We will begin with the firm positioning within the business network. We will then analyse the marketing and sales management in downstream relationships. We will conclude with the procurement and supply management in upstream relationships.

Throughout the analysis, we will link these three parts with each other in order to understand how a firm operates in extended business networks.

- Part I: Firm Positioning within the Business Network

2.1. The attractiveness of the network

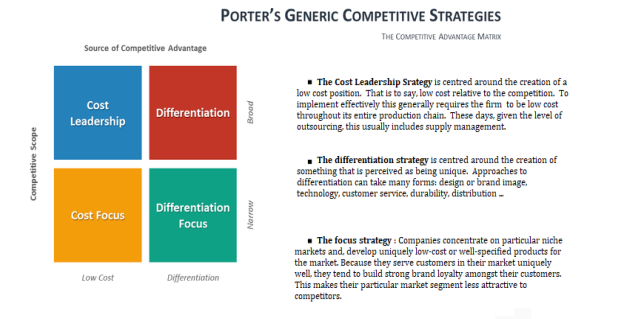

Every firms committed to develop a powerful activity should seek to find the most attractive position in a business network by considering the competitive environment at each stage of the network (IBS&SCM Lecture notes, Week 1). To that end, Michael Porter introduced the Porter’s Five Forces in order to have a better understanding of the competitiveness of a business environment and to identify its potential profitability (Michael Porter, 1979 in Ash D., Bowman C, 1989). The intensity of competition will depend on: Buyer power, Supplier power, Substitutes, Potential entrants, Competitive rivalry (Figure 1). Porter’s Fives Forces are an important tool for understanding the forces that shape competition within an industry as well as for helping a firm to adapt a strategy to the competitive environment, and to enhance the potential profit. Indeed, through this analysis, a firm can easily think about how each forces impact the business organisation, by giving its strengths and direction, and therefore, assessing the firm’s position. A firm can look at what changes need to be made in order to get a long-term profit and therefore consider what strategies need to be carried. For that purpose, it is interesting to consider Porter’s Generic strategies, which allows to understand how a company pursues competitive advantage across its chosen market scope (Figure 2).

A firm can thus set out its position within the business network particularly in relation to the market structures and generic strategies, allowing an organisation to hold different degrees of attractiveness.

2.2. Re-positioning Strategy

However, it is also possible for a firm to reconsider its position within the business network. IBM and its acquisition of PwC Consulting is a relevant example of a re-positioning strategy. Initially focused on their hardware and software products, IBM shifted their position, seeking to deliver business value to clients. IBM improved its strategy by acquiring PwC Consulting in 2002, allowing the company to move from its initial position to a position where IBM provides consulting services to customers. In deed the company created a new business unit for customers seeking a partner with deep expertise combined with its technology (IBS&SCM case exercise, Week 3). This illustrates the concept of “Zones of manoeuvre” (Peter Clark, 1999). A company has zones of manoeuvre within which they can operate and move successfully into these new positions, positions which will change in attractiveness (IBS&SCM Lecture notes, Week 3).

2.3. Outsourcing Strategy

Another strategy where organisations access knowledges and skills located beyond their boundaries is the “outsourcing” decision. This strategy is based on contracting out activities that were previously within the firm. It is expected that outsourcing will make the firm more productive and profitable (IBS&SCM Lecture notes, Week 3). A firm can involve the outsourcing of activities to achieve cost savings as well as improving company focus on more strategic issues. In the 1995, Gene Richter, IBM’s head of purchasing realized that the technology that IBM needed for its components, could be provide by outside suppliers, and that would allow to reduce their costs. IBM thus shifted from manufacturing to outsourcing (Spekman R., Davis EW., 2016). This example shows how strategic outsourcing can transform a struggling manufacturing company into a competitive firm. Through this strategy, IBM redefined its core business, necessary for a sustainable competitive advantage.

Different positions within the network will possess a different degree of attractiveness. Firms will try to change their positioning in order to have more attractive positions in the network.

- Part II: Marketing and Sales Management in Downstream Relationship

3.1. Maximizing Surplus value

Having analysed positioning and firm boundary decisions, let’s now consider the concept of “surplus value”, essential in downstream and upstream process.

Jonathan Birkin defines this concept as “the difference between the revenue generated from the customers and the overall cost across that supply chain”. It explains how company can create value and add more value by creating a competitive strategy (Michael Porter, 1985). Organisations must know how to control and manage cost and add value to buyer’s value chain as well as limiting the bargaining of the supplier in order to get added value. Firms seek to accumulate value for themselves by constantly leveraging their customers and suppliers. To that end, it is important to consider the relative strength of the power between buyer and supplier (Cox, 2001-2004).

In the following, we will make this clear by addressing the importance of having powerful relationships with both customers and suppliers and how to manage that.

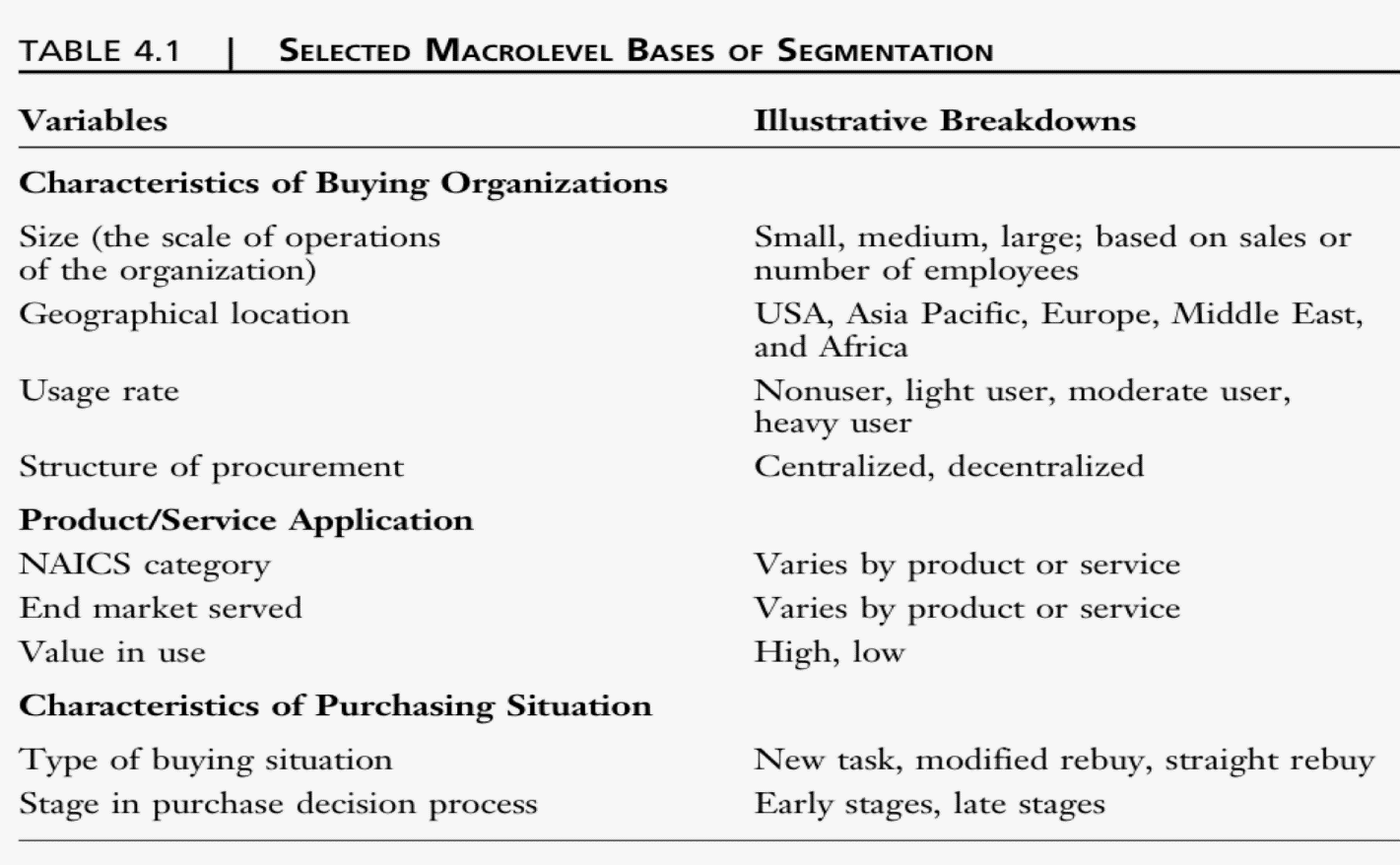

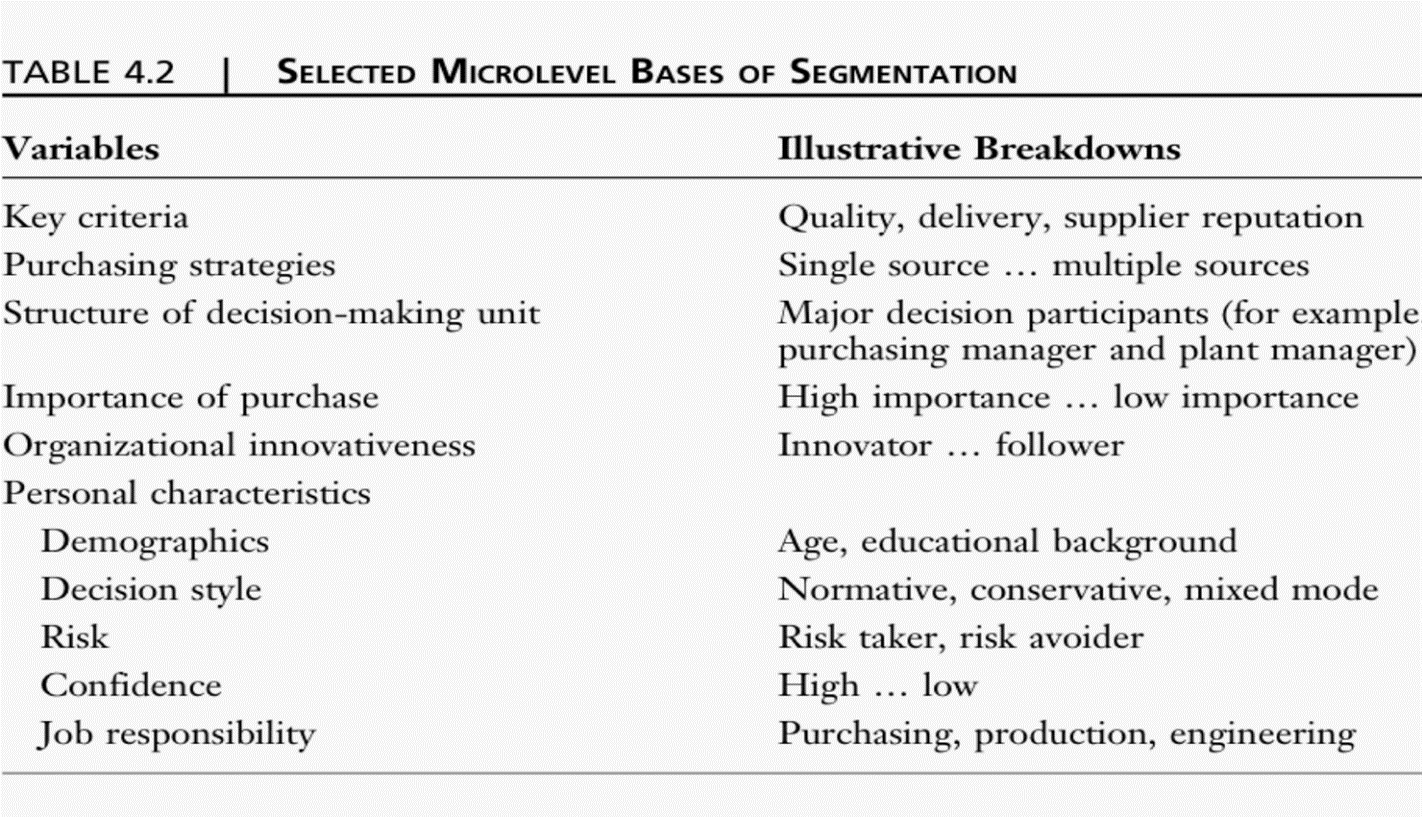

3.2. Setting Segmentation Strategy

The first dimension we will tackle is related to the downstream network, used to persuade clients to conduct purchase from our organisation instead of from rivals. This concept first goes through the market segmentation strategy, a group of present or potential customers with some common characteristic which is relevant in explaining their response to a supplier’s marketing stimuli (Y. Wind & R. N. Cardozo, 1974). It is important for a firm to assess the market and identify which parts should be focused on in order to be profitable. For that purpose, a firm needs to run both macro and micro analysis of the market, as shown in figures 3&4, and then adapt its strategy accordingly to its segmentation. IBM divided its customers into three diverse groups. The company had to develop a portfolio of relationship strategies in order to satisfy the target customers. IBM tried to meet the needs of each groups by developing ranges of IT products, acquiring high-quality raw materials or developing a pricing policy, such as setting orders for reasonable prices or increasing switching-costs of customers (Michael D. Hutt; Thomas W. Speh, 2013). Therefore, firms must be attuned to the needs of customer segments in order to develop powerful relationships and attractiveness.

3.3. Obtaining and Retaining Customers

Knowing the needs of specific market segments will now help to obtain and retain customers. Good knowledge of customer behaviour makes it easier to determine how to best reach out to a chosen audience through advertising (J. Abbey, 1989). Advertising is one way of promoting a company. Firms seek to create awareness of their products and services among potential customers. In the 90s, IBM realised that most customers were not aware of the company as a services provider with its single services entity, IGS. Despite dominant IGS’s services revenues, the low awareness of IGS causes a low intention to buy services from IBM (IBS&SCM case exercise, Week 7). The company came to an end that an advertising campaign was essential in order to establish a strong market brand and then renew with customers awareness. Additionally, advertising to attract customers goes hand in hand with the objective of retaining them as potentially loyal customers (Hughes, 2003). When launching a well-run advertising campaign, customers feel like they get extra value for less cost (Plog, 2004

),

which can contribute to build strong relationships and therefore retain a large range of customers.

- Part III: Procurement and Supply Management in Upstream Relationship

4.1. Value For Money Concept

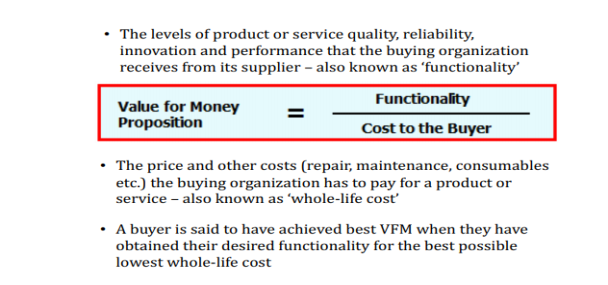

Another important issue concerns the upstream network which is the company’s relationships with its customers through procurement and supply process. Building strong relationships with the suppliers, by involving them in the business process and collaborating with them is a key aspect in the supply management process (McIvor, 2000). It is first important to consider the Value For Money (VFM) concept as shown in figure 6, which is about achieving the optimum combination of whole-life costs and functionality. In other words, a company formulates its purchasing decision by getting the right quantity and quality of goods or services from better suppliers at best prices. Therefore, this concept is closely linked to the procurement process. Supplier selection is the process by which the buyer identifies and evaluates suppliers to find the profitable one, seeking the best VFM proposition.

4.2. Supplier Selection

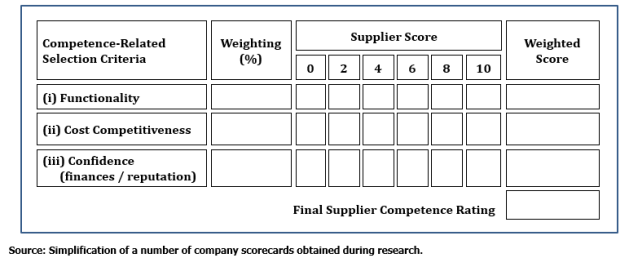

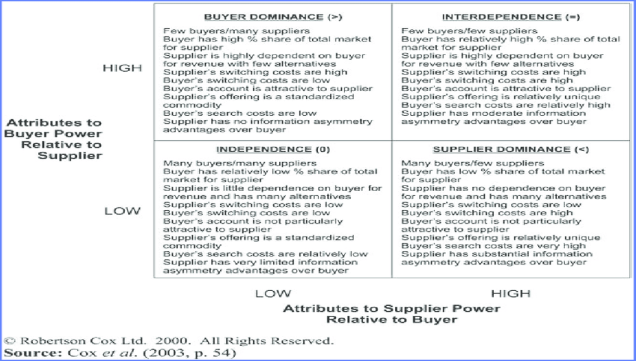

This selection is first based on supplier competence criteria. When choosing a supplier, a company might trade-off between functionality, cost competitiveness and confidence in the supplier, giving an overall rating based on supplier competencies (Figure 7). However, an understanding of supplier competence must be related to the supplier congruence, i.e. buyer-supplier power, to make an effective selection, consistent with the VFM requirements of the buyer. It is thus essential to consider the concept of buyer-supplier power and its impact on buyer supplier relationships (Cox et al, 2000; Cox et al, 2002; Cox et al, 2003). The figure 8 shows four approaches for positioning those relationships. Undertaking such congruence analysis aims to establish what the incentives are in a buyer-supplier relationship.

4.3. Supplier Relationship Management

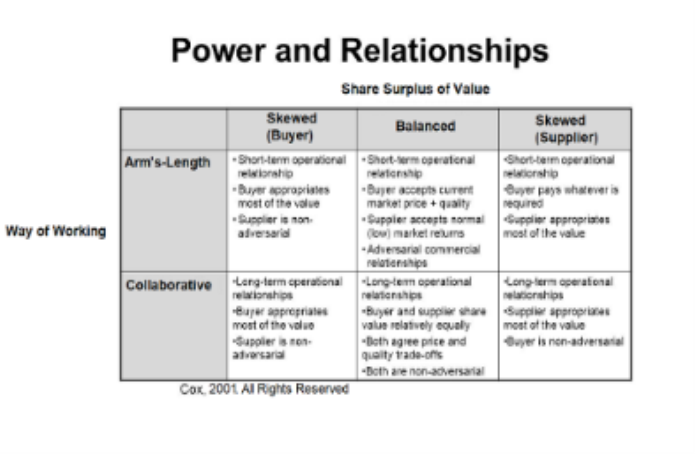

Finally, the buying organisation needs to focus on the supplier performance (SPM) and relationship management (SRM) to ensure that the buyer-supplier relationships will deliver long term value to both parties. Those relationships are particularly interesting regarding to the share of surplus value between the two parties (Cox, 1999) as explained in figure 8. In this case, the SPM is defined as the whole matrix whereas the SRM is the choice of a specific relationships style. This model explains which type of relationships are likely to be found in which power circumstances and recognises which buyer-supplier relationships should be considered. IBM for instance gives priority to collaborative and balanced relationships.

- Conclusion

A firm’s position within its business environment is crucial. Every firms seek to find the best position in terms of attractiveness and therefore profitability. Once the company has adapted to the competitive environment, it is now critical to consider its relationships and the way to manage them in order to remain attractive. This involves both customers and suppliers management. The ultimate aim for a company is thus to develop strong relationships, beneficial to all, in order to operate effectively in its business network.

References

- Abbey, J. R. 1989, Hospitality Sales and Advertising, The educational institute of the American Hotel & Motel Association. Michigan, USA. Education Institute

- Birkin, J. 2012, Intermediate Teacher’s Book, Business Advantage, Cambridge, Cambridge University Press

- Cannon, Joseph P., and William D. Perreault, Jr., Nov. 1999, Buyer- Seller Relationships in Business Markets, Journal of Marketing Research, XXXVI, (November), pp. 439-460

- Clark, P., 1999, Organizations in Action: Competition between Contexts, Routledge New York, NY

- Cox, A. 2001, Understanding buyer and supplier power: A framework for procurement and supply competence, Journal of Supply Chain Management 37(2):8-15.

- Cox, A., Sanderson, J. and Watson, G., 2000, Power Regimes, Boston: UK, Earlsgate Press

- Cox, A., Ireland, P., Lonsdale, C., Sanderson, J. and Watson, G., 2002, Supply Chains, Markets and Power, London, Routledge

- Cox, A., Ireland, P., Lonsdale, C., Sanderson, J. and Watson, G., 2003, Supply Chain Management, London, Financial Times Pearson

- Cox, A., 1999, ‘Improving Procurement and Supply Competence’, in Strategic Procurement Management: Concept and Cases, Richard Lamming and Andrew Cox (eds), Boston: Earlsgate Press

- Holmlund, M., Törnroos, J-A, 1997, Management Decision, What are relationships in business networks, , Vol. 35 Issue: 4, pp.304-309

- Hughes A, 2003, The Customer Loyalty Solution, What Works (and What Doesn´t) in Customer Loyalty Programs, McGraw- Hill, USA

- Hutt, M. D., Speh T. W., 2013, Business Marketing management: B2B, Australia, Mason, OH : South-Western, Cengage Learning, 11th ed, pp. 91

- Lee, H. L., Billington, C., and Carter, B., 1993, Hewlett-Packard gains control of inventory and service through design for localization. Interfaces, 23(4), 1-11

- McIvor, R., 2000, ‘Electronic commerce: reengineering the buyer-supplier interface’, Business Process Management Journal, 6(2), pp. 122-138

- Pfeffer and Salancik 1978; Sanchez and Heene, 1997, ‘Sources of asymmetric power relations’ in Kimura, S., 2006, The Challenge of late industrialization: The global economy and the Japanese commercial aircraft industry, Spinger, pp. 45

- Plog S, 2004, Leisure Travel, A marketing Handbook, Pearson Education Inc, New Jersey, USA

- Porter, M. E., 1980, Competitive Strategy: Techniques for Analyzing Industries and Competitors, NY: The free press

- Porter, M. E., 1979, ‘How Competitive Forces Shape Strategy’, in Ash, D., Bowman C., 1989,Readings in Strategic Management, Macmillan Publishers Limited, pp. 133-143

- Porter, M. E., 1985, Competitive Advantage: Creating and Sustaining Superior Performance, NY: The free press

- Spekman, R., Davis, E. W., 2016, ‘The extended enterprise: a decade later’, International Journal of Physical Distribution & Logistics Management, Vol. 46; pp.140

- Wind Y. and Cardozo, R. N., 1974, ‘Industrial Market Segmentation’, Industrial Market Management 3, pp. 155

Appendix

Figure 1: Porter’s Five Forces

Source: Adapted from Harvard Business Review. From Porter, M., 1979, How Competitive Forces Shape Strategy, the Harvard Business School Publishing Corporation

Figure 2: Porter’s Generic Competitive Strategies

Figure 2: Porter’s Generic Competitive Strategies

Source: Adapted from Porter, Michael E., 1985, Competitive Advantage, Ch. 1, The Free Press. New York., pp 11-15.

Figure 3: Selected Macrolevel bases of Segmentation

Source: Hutt, M. D., Speh T. W., 2013, Business Marketing management: B2B, Australia, Mason, OH : South-Western, Cengage Learning, 11th ed, pp. 100

Figure 4: Selected Microlevel Bases of Segmentation

Sources: Hutt, M. D., Speh T. W., 2013, Business Marketing management: B2B, Australia, Mason, OH : South-Western, Cengage Learning, 11th ed, pp. 103

Figure 5: Value For Money

Figure 5: Value For Money

Source: IBS&SCM, Lecture notes and case exercise, Week 5

Figure 6: Supplier Selection – Competence Related Selection Criteria

Figure 6: Supplier Selection – Competence Related Selection Criteria

Source: Simplification of a number of company scorecards obtained during research in IBS&SCM, Lecture notes, Week 8

Figure 7: The power matrix: The attributes of buyer and supplier power

Source: Cox, A., Ireland, P., Lonsdale, C., Sanderson, J. and Watson, G., 2003, Supply Chain Management: A Guide to Best Practice, Financial Times/Prentice Hall, Lond

Figure 8: Power and Relationships

Figure 8: Power and Relationships

Source: Adapted from Cox, A., 1999, ‘Improving Procurement and Supply Competence’, in Strategic Procurement Management: Concept and Cases, Richard Lamming and Andrew Cox (eds), Boston: Earlsgate Press

What Students Are Saying About Us

.......... Customer ID: 12*** | Rating: ⭐⭐⭐⭐⭐"Honestly, I was afraid to send my paper to you, but you proved you are a trustworthy service. My essay was done in less than a day, and I received a brilliant piece. I didn’t even believe it was my essay at first 🙂 Great job, thank you!"

.......... Customer ID: 11***| Rating: ⭐⭐⭐⭐⭐

"This company is the best there is. They saved me so many times, I cannot even keep count. Now I recommend it to all my friends, and none of them have complained about it. The writers here are excellent."

"Order a custom Paper on Similar Assignment at essayfount.com! No Plagiarism! Enjoy 20% Discount!"